By Justin Fundalinski, MBA | October 15, 2015

October in the office is synonymous for Medicare. Open enrollment is discussed rather frequently considering it begins on October 15th and certainly could impact any of our clients who are on Medicare. This month however, I would like to diverge into something that is likely to have a big impact in the long run. Ever heard of MACRA? How about the Doc Fix Bill? Well, the Medicare and CHIP Reauthorization Act (a.k.a MACRA, a.k.a. Doc Fix) was passed in an overwhelming Senate and House majority (92 to 8 and 392 to 37, respectively) in essence to prevent a pay cut to physicians, to keep physicians from dropping Medicare as an insurance provider, and to add funding to Medicare.

One Sentence Summary of MACRA:

MACRA is a new law that is intended to replace the current payment system for physicians from a quantity based payment structure to a quality of care payment structure with provisions that increase Medicare premiums paid by beneficiaries to help offset the costs that come along with the new system.

How the changes from quantity to quality based payments rolls out in the end will be subject to scrutiny over the coming years with likely opposition to the final structure from both physicians and Medicare beneficiaries. However, there are some pretty clear estimates of how premiums will be impacted and some indirect effects to people’s premiums when this law is viewed in conjunction with the Affordable Care Act (a.k.a ACA or ObamaCare)

The Obvious:

Medicare premiums are based off of income levels. For instance, currently single individuals with $85,000 or less in Modified Adjusted Gross Income (MAGI) (double this figure for married couples) pay a “standard premium” of about $105 monthly for their Medicare premiums. What this means is that if you make $85,000 or less you pick up 25% of your health insurance premium and the government picks up the other 75% (much like when you work for an employer you pay a part of the health care premium and your employer pays a part of it). Anyone who makes more than this will pay more than the standard premium of 25%, and the amount they pay depends on how much more they make. These are called income related premiums and depending on your income you will pay 35%, 50%, 65% or 80% of the premium.

The new law clearly makes some changes to this and on its surface level it appears that it will only affect higher income individuals or couples. It shifts some of the thresholds around so that only those that make over $133,500 (double for couples) will be impacted by premium increases caused by the law (remember this is on top of any normal premium increases that all Medicare beneficiaries are affected by).

An easy way to think about this is that some of the higher income earners that used to pay 50% of the total premium will now have to pay 65% and similar adjustments are made all the way up to the top where more people will be paying 80% of the total premium. Below you will find a chart from ObamaCare Facts that illustrates all of these bracket changes if you are interested in more details (I have put the changes in bold for easier reading).

| Current MAGI limits |

Premium percentage |

MAGI limits beginning in 2018 |

Premium percentage |

| Less than or equal to $85,000* |

25% |

Less than or equal to $85,000* |

25% |

| Greater than $85,000 and less than or equal to $107,000* |

35% |

Greater than $85,000 and less than or equal to $107,000* |

35% |

| Greater than $107,000 and less than or equal to $160,000* |

50% |

Greater than $107,000 and less than or equal to $133,500* |

50% |

| Greater than $160,000 and less than or equal to $214,000* |

65% |

Greater than $133,500 and less than or equal to $160,000* |

65% |

| Greater than $214,000* |

80% |

Greater than $160,000* |

80% |

*Limits for married couples are twice the limits listed here. Starting in 2020, all income thresholds will be updated (indexed) annually for inflation.

The Not So Obvious:

Unfortunately, the percentage of people that must pay income related premiums is forced to increase due to the Affordable Care Act. Currently, the brackets that were discussed above have been frozen since 2011, they will not be adjusted due to normal inflation, and are intended to remain frozen until 2019 (cross our fingers it does not get pushed out any further). This “freezing” causes the brackets to remain the same while people’s income naturally grows due to inflation adjustments. So what is the effect of this? Well, a Kaiser Family Foundation study estimated that between 2013 and 2019 the percentage of Medicare beneficiaries that must pay income related premiums will nearly double from 4.6% to 8.3%. Undoubtedly, some groups of people are now going to be pushed above the $133,500 bracket and be directly affected by MACRA.

The Even Less Obvious:

A little off topic from MACRA but a perfect transition from the previous paragraph; because most readers of this will probably not care too much about the premium increases since they do not have a Modified Adjusted Gross Income greater than $133,500 (double for couples) there is a hidden affect that is often overlooked. What people are missing is a little known rule that was built to protect only those that do not have income adjusted premiums. This rule is called the hold harmless rule and in a very general sense exists so that a raise in Medicare premiums cannot reduce the amount of Social Security income that you take home (remember premiums are subtracted from your Social Security benefit).

Well for those who are anywhere near the brink of $85,000 in annual income this hold harmless provision may quickly be stripped from you. As stated earlier the percentage of people that must pay income related premiums is expected to nearly double by 2019. Every person that is forced into an income related premium bracket (due to the freezing of brackets under the Affordable Care Act) will lose the hold harmless provision that protected their Social Security take home pay from ever decreasing.

What does this mean? Well, Social Security benefits inflate at a rate much slower than Medicare premiums so it is quite possible that Social Security benefits will be chewed up by Medicare premiums for anyone that was forced into these higher brackets. When could this happen? Really it could happen any time a Medicare premium increase is greater than the cost of living adjustment for Social Security. It is not likely to have a substantial impact in the near future because Medicare premiums are not a large percentage of Social Security benefits. However, many years down the road when Medicare premiums have inflated to levels substantially higher than today significant impacts to Social Security benefits may be realized. What’s the likelihood that this occurs? Who knows what the future holds, but historically it happened as recently as 2010, 2011, 2013, and is likely to happen again in 2015.

What Does It All Mean?

When it comes to MACRA the proof will be in the pudding when doctors implement the quality of care based payment structure and abandon the current quantity of care structure. That is, having less doctor’s visits and better care given sounds great to me, but let’s not assumes this patch is the panacea to an already broken Medicare system. Time will tell and more patches will be applied over the years to Medicare as well as this specific law itself.

When it comes to the ACA’s freezing of the Medicare income brackets (another patch), what’s done is done and more people will be paying income related premiums and losing the hold harmless provision that protects their take home Social Security from ever going down. Something to keep an eye on is whether or not the freezing of the Medicare income brackets gets extended beyond 2019 and forces even more people into income related premiums.

Several years ago, I wrote an

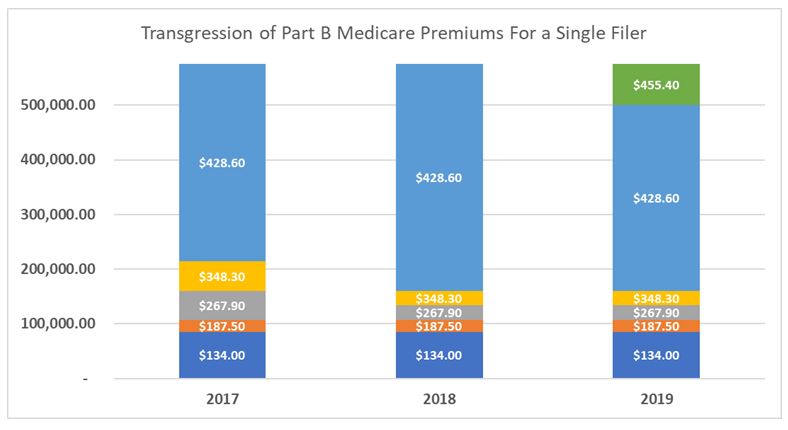

Several years ago, I wrote an  The graph above outlines the transgression of Medicare Part B premiums from 2017 through 2019. It illustrates what premium you would pay in 2017, 2018, and 2019 dependent on the amount of Modified Adjusted Gross income you have. You can see how from 2017 to 2018 the thresholds that force people into higher Medicare Premiums began to be compressed into lower thresholds once income was greater than $133,500 (this was discussed in detail in the previous article). From 2018 to 2019 they will be maintaining those compressed thresholds but also adding a new tier of premiums once income is beyond $500,000.

The graph above outlines the transgression of Medicare Part B premiums from 2017 through 2019. It illustrates what premium you would pay in 2017, 2018, and 2019 dependent on the amount of Modified Adjusted Gross income you have. You can see how from 2017 to 2018 the thresholds that force people into higher Medicare Premiums began to be compressed into lower thresholds once income was greater than $133,500 (this was discussed in detail in the previous article). From 2018 to 2019 they will be maintaining those compressed thresholds but also adding a new tier of premiums once income is beyond $500,000.

We recently came across a case in which a retired PERA employee worked many of her years during the time when employees did not contribute to Medicare taxes, but also worked some of her years during a time that they did contribute to Medicare taxes. The end result was that she did not earn her 40 quarters of credit to qualify for “free” Medicare Part A insurance (the hospital insurance side of Medicare), but instead fell short by just a few credits. While PERA has some options available to employees who do not qualify for free Part A, the options are not clear cut from a financial position and we were forced examine them deeply. It came down to a couple factors and in this month’s newsletter we want to share some of our findings for those who participate in PERACare for retirees currently or for those who may be faced with some of the same options in the future.

We recently came across a case in which a retired PERA employee worked many of her years during the time when employees did not contribute to Medicare taxes, but also worked some of her years during a time that they did contribute to Medicare taxes. The end result was that she did not earn her 40 quarters of credit to qualify for “free” Medicare Part A insurance (the hospital insurance side of Medicare), but instead fell short by just a few credits. While PERA has some options available to employees who do not qualify for free Part A, the options are not clear cut from a financial position and we were forced examine them deeply. It came down to a couple factors and in this month’s newsletter we want to share some of our findings for those who participate in PERACare for retirees currently or for those who may be faced with some of the same options in the future. With open enrollment for Medicare around the corner (October 15 through December 7th) maybe it’s time to start talking a bit about some important things to be looking out for. Rather than trying to write an all-encompassing article about Medicare, let’s start with one part of Medicare, specifically prescription Part D.

With open enrollment for Medicare around the corner (October 15 through December 7th) maybe it’s time to start talking a bit about some important things to be looking out for. Rather than trying to write an all-encompassing article about Medicare, let’s start with one part of Medicare, specifically prescription Part D.