By Justin Fundalinski, MBA | July 20, 2018

Several years ago, I wrote an article about the changes coming in 2018 on income related Medicare premiums. Better known as the Income-Related Monthly Adjustment Amount (or IRMAA), this provision of Medicare rears its head and increases Medicare premiums as individual or couple’s income rises. It’s essentially an added tax, or a way to help fund an underfunded Medicare program.

Several years ago, I wrote an article about the changes coming in 2018 on income related Medicare premiums. Better known as the Income-Related Monthly Adjustment Amount (or IRMAA), this provision of Medicare rears its head and increases Medicare premiums as individual or couple’s income rises. It’s essentially an added tax, or a way to help fund an underfunded Medicare program.

In the article I discussed the coming changes and how the income thresholds used to determine whether someone is subject to increased Medicare premiums are normally adjusted for inflation. Generally, as a retiree’s income naturally grows due to inflation they are not forced over higher thresholds and thus higher Medicare premiums. At the time of the article those brackets had been intentionally frozen (under the Affordable Care Act) to slowly force more people into higher premiums between the years 2011 and 2019. However, while the thresholds are still frozen (and always subject to extension), the Bipartisan Budget Act of 2018 (Trump Tax Reform) made some notable changes that require an update and some review.

Changes as of 2018 Bipartisan Budget Act

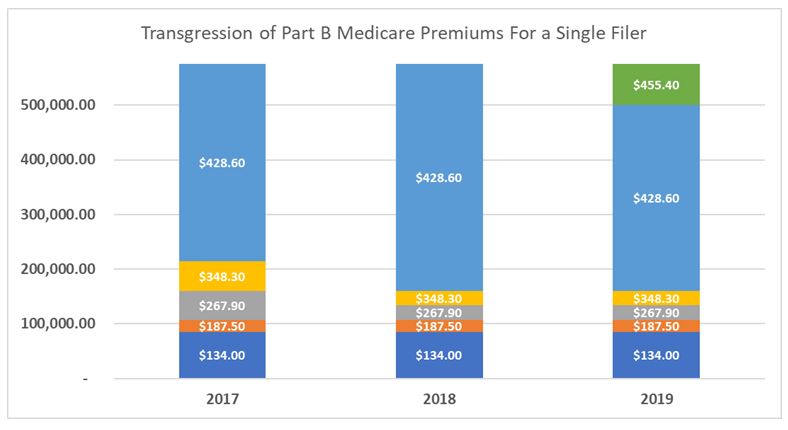

Most notably, the Bipartisan Budget Act of 2018 piled on top of the changes that took effect in 2018 and added an additional threshold/tier of surcharges that will be introduced in 2019. Currently, there are five different Medicare premium levels based on the income levels of the Medicare recipient. In 2019 there will be six.

The graph above outlines the transgression of Medicare Part B premiums from 2017 through 2019. It illustrates what premium you would pay in 2017, 2018, and 2019 dependent on the amount of Modified Adjusted Gross income you have. You can see how from 2017 to 2018 the thresholds that force people into higher Medicare Premiums began to be compressed into lower thresholds once income was greater than $133,500 (this was discussed in detail in the previous article). From 2018 to 2019 they will be maintaining those compressed thresholds but also adding a new tier of premiums once income is beyond $500,000.

The graph above outlines the transgression of Medicare Part B premiums from 2017 through 2019. It illustrates what premium you would pay in 2017, 2018, and 2019 dependent on the amount of Modified Adjusted Gross income you have. You can see how from 2017 to 2018 the thresholds that force people into higher Medicare Premiums began to be compressed into lower thresholds once income was greater than $133,500 (this was discussed in detail in the previous article). From 2018 to 2019 they will be maintaining those compressed thresholds but also adding a new tier of premiums once income is beyond $500,000.

Married Filing Jointly

What is interesting about the new 2019 brackets is when you look at them for someone who files their taxes married filing jointly. In all previous cases, the thresholds illustrated here for a single filer would double for a married couple. However, to reach the highest threshold in 2019 as a married filing jointly person your income will have to be greater than $750,000 (not $1,000,000 had the normal trend followed suit). That’s only a 1.5X increase instead of the normal 2X. I interpret that as a penalty for being married.

Although, this won’t affect most households it is important information to know. Why? Well if these thresholds continue to be frozen, then over time more and more people will be forced into higher premium levels simply because their income grew with inflation (this is above and beyond the normal adjustment for increased insurance costs). Currently, the thresholds are scheduled to begin getting adjusted for inflation again in 2020, however I wouldn’t count on it. My argument on why I believe this is thoroughly outlined in a previous article I wrote in 2016 called, “Trickle-Down Taxes” In this article I argue how sneaky policy that is presented to tax the rich is really designed to very slowly increase taxes on the masses.

If you have any questions or comments on this article, please feel free to reach out to the office.