By Justin Fundalinski, MBA | May 20, 2018

“Sequential risk” or “sequence of returns risk” is a well-defined and highly discussed term in the retirement planning and investment industry. Under certain circumstances it can be one of the largest risks pre-retirees and early retirees face. Much of the basis of our firm’s retirement planning strategies is formed around managing this risk, and the highly recognized “4% withdrawal rate rule” was developed in lieu of this risk. Unfortunately, many who are reaching retirement or already retired simply don’t understand sequential risk, and do not place enough weight on managing it effectively. In this month’s article I intend to define in simple terms what sequential risk is and hopefully inspire people to take action.

“Sequential risk” or “sequence of returns risk” is a well-defined and highly discussed term in the retirement planning and investment industry. Under certain circumstances it can be one of the largest risks pre-retirees and early retirees face. Much of the basis of our firm’s retirement planning strategies is formed around managing this risk, and the highly recognized “4% withdrawal rate rule” was developed in lieu of this risk. Unfortunately, many who are reaching retirement or already retired simply don’t understand sequential risk, and do not place enough weight on managing it effectively. In this month’s article I intend to define in simple terms what sequential risk is and hopefully inspire people to take action.

What is Sequential Risk?

A little thought experiment will help describe how the sequence of returns makes a difference. Imagine your portfolio averages a 6% return over 5 years. Now imagine you have $1,000,000 invested but you need to withdraw $100,000 per year over the next five years.

We all know that you will never get an easy 6% every year and one year your portfolio can be up big while other years it can suffer losses.

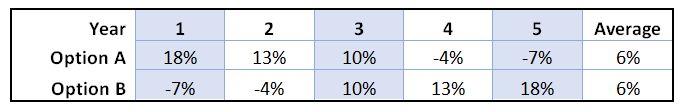

You have a choice between two options that will return annual rates as follows:

Both options return the same average return of 6% year over the 5-year period and have the exact same return rates, however the year the returns occur are reversed. If you simply invested the $1,000,000 for the five years your total return and portfolio values would be exactly the same both options.

However, if you need to withdraw money yearly, the ending value of each option is drastically different. In these cases, when you start with $1,000,000 and need $100,000 each year, Option A ends with a total value of about $818,000 while Option B ends with a total value of about $671,000. Option A is 22% greater than Option B and the only difference is when the returns occurred not the size of the returns! This is sequential risk and once withdrawals begin being taken from a portfolio it becomes a reality.

That all said, you can now hopefully see why people who had retired before or close to the market downturn in 2007 and 2008 (and thus were withdrawing funds from their portfolios to meet their income needs) were negatively affected and quite possibly in the long run bad timing could ruin their retirement prospects.

When Does Sequential Risk Impact You the Most?

Without hesitation I can say the actual impact of sequential risk is at its greatest level in year one of retirement. The reason behind this a because day one of retirement is when withdrawals begin from the portfolio (withdrawals being what subjects retirees to the risk itself – as described above) and because the portfolio must last for its longest period of time (30+ years of retirement). However, and with emphasis, the actual sequence of returns leading up to retirement cannot be ignored because they play into the portfolio value for years after they occurred.

Negative or bad returns leading up to retirement can and will undoubtedly subject retirees to sequential risk if a portfolio does not have time to recover before withdrawals being. That said, depending on your level of conservatism, pre-retirees should start addressing sequential risk at least 7 years before withdrawals will be needed and retirees can start phasing out the worry of such risk around 7 years into retirement as the portfolio won’t have to last as long anymore.

How Can Sequential Risk Be Addressed?

Addressing sequential risk can be done in many ways and the strategies vary for every person depending on how exposed they are to the risk as well as their personal investment philosophies. Getting into the details is outside the scope of this article, however we highly recommend some in-depth retirement planning be done in advance of addressing the risk itself (hence why we recommend advance retirement planning 5-10 years prior to retirement).

It is important to identify expenses that make up your minimum dignity floor which cannot be reduced during down markets. It is important to accurately project income sources such as Social Security, Pension, and Annuities that are guaranteed to always be paid. It is important to project the size of withdrawals needed in relation to your total portfolio. It is important to consider longevity and health concerns. Everybody is different and there is no one size fits all answer to this question, but effectively managing downside risks on funds needed early in retirement is necessary.

If you have any questions regarding this article or would like to discuss your exposure to sequential risk, please feel free to set up a meeting with us.