By Jo Madonna, E.A. | August 16, 2019

A Closer Look at Social Security Taxation: The Importance of the Combined Income Calculation

If you’re concerned about whether – or how – your Social Security benefits will be taxed, you’re either already over 62 and living with monthly Social Security deposits into your bank account, or working on your retirement planning for when they do start arriving.

Even though we know Social Security alone is insufficient to support us in retirement, for many it still forms a consequential part of their spending plan as they move from active to passive income generation. If Social Security benefits are going to be taxed, it’s important to know so in advance.

Many assume that Social Security benefits are free of taxes, but they are wrong. Although IRS rules do provide some protection when taxing Social Security benefits, the more additional sources of taxable income you have, the more your Social Security benefits will be taxed. That income could come from wages, self-employment efforts, dividends, required distributions and any other income that you will have to report to the IRS.

Each January, the IRS will send you a Form SSA-1099, or Social Security Benefit Statement, that shows how much you received in benefits in the prior year. If you don’t receive a Form SSA-1099, a replacement is available online through your My Social Security account.

This is the information you will use, along with your other income information, to determine if you have to pay tax on your Social Security benefits or not.

Using the Combined Income Calculation

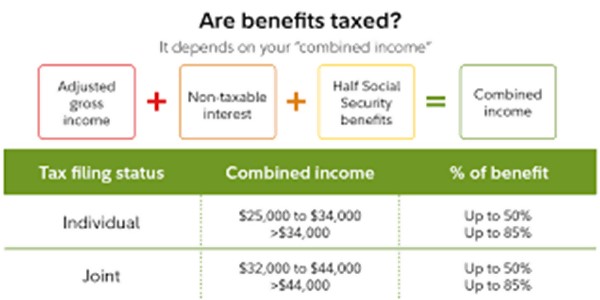

The first step to knowing if any of your Social Security benefit is taxable is to use a special IRS calculation called the “Combined Income Calculation.” That calculation is: adjusted gross income + nontaxable interest + ½ of your Social Security benefits.

Your adjusted gross income

+ Nontaxable interest

+ ½ of your Social Security benefits

= Your “combined income”

For example, if you have $30,000 in wages, $5,000 in tax-free interest from bonds and $22,000 in Social Security benefits, $46,000 is the Combined Income number that you will use to determine if any of your Social Security benefits will be taxable.

Base Limits for Taxes Owed

You will never pay tax on more than 85 percent of your Social Security benefits. If and how much you pay depends on your filing status and two specific Combined Income ranges. The amount will be calculated on a sliding scale that is based on your income.

- The base limits that put single filing taxpayers into taxation calculation are:

- $25,000-$34,000, which will put up to 50% of Social Security into taxation.

- Above $34,000, which will put up to 85% of Social Security into taxation.

- The base limits that put married filing joint taxpayers into taxation calculation are:

- $32,000-$44,000, which will put up to 50% of Social Security into taxation.

- Above $44,000, which will put up to 85% of Social Security into taxation.

Calculating the Impact on Taxable Income

If your Combined Income puts you in one of the ranges where up to 50 percent of your Social Security benefits are taxable, the exact amount you enter as taxable income (on your Form 1040) will be the lower of either (a) half of your annual Social Security benefits, or (b) half of the difference between your Combined Income and the ‘IRS base amount’ ($25,000 or $32,000, depending on how you are filing).

For example, as a single filer who received $19,000 in Social Security benefits last year, half of that would be $9,500. If your Combined Income was $33,000, the relevant ‘IRS base amount’ would be $25,000. The difference between your Combined Income ($33,000) and the ‘IRS base amount’ ($25,000) would be $8,000. You would enter $8,000 as the taxable amount on your Form 1040 because it is lower than half of your Social Security benefits last year ($9,500).

Our earlier example gave us a Combined Income figure of $46,000. Whether filing as a single taxpayer or married filing joint taxpayer, that figure put up to 85 percent of the Social Security benefits into taxation. Here calculations become far more complicated, and the IRS offers further explanations and a worksheet to help: worksheet to calculate Social Security tax liability.

What About State Taxes on Benefits?

So far we have only looked at Federal income taxes. Are Social Security benefits taxed at the state level as well? If we are calculating the net cash available for spending or for our retirement planning, we would need to know.

Thirteen states tax Social Security benefits as income. Check for details if you live in Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont or West Virginia.

The Impact on Retirement Planning

Smart Social Security strategies are only one element of your retirement planning, but one worth developing since it becomes part of the guaranteed lifetime income you will want available for the rest of your days. As experts in Social Security and Tax Planning, we would welcome the opportunity to help you plan yours.