By Bob Palechek, CPA | July 19, 2019

The Affordable Care Act (ACA) – nicknamed Obamacare – was disappointing for some, but a godsend for others. If today it is your solution for healthcare coverage, you will want to take maximum advantage of one aspect of it called the ‘Premium Tax Credit,’ assuming you qualify.

The Premium Tax Credit (PTC) is a tax credit ‘advance’ that qualifying taxpayers can receive to help pay the cost of the private health insurance they are purchasing through a Health Insurance Marketplace.

It is considered an ‘advance’ because you can choose to benefit from it every month as a reduction in the cost of your monthly health insurance premium. Whatever sum is determined for you by the HHS formula will be paid directly to the insurance company to lessen how much you have to pay out of your pocket for premiums.

You can also choose not to apply the credit to your insurance premiums. Instead, you can wait to receive it when you file your tax return. In that case, if the amount of the annual credit is higher than your tax liability, the difference will come back to you as a tax refund. And if you owe no taxes, the full amount of the year’s credit will be refunded to you.

Who Can the Premium Tax Credit Benefit?

This tax credit may be available to those paying for their own health insurance. For example:

- Those whose employers do not offer to pay for health insurance;

- The self-employed; or

- People retiring before the age of 65 (when Medicare kicks in), whether they are giving up employer-paid health insurance or not.

However, their household income cannot exceed 400% of the ‘Federal Poverty Line,’ or FPL. The FPL is affected by:

- Where you live (Alaska and Hawaii’s ‘lines’ differ from the rest of the country);

- Your family size, which is the number of people you will include on your tax return for the year; and

- Your income which, for PTC purposes, equals your AGI plus tax-exempt interest.

For example, if you and your spouse live in one of the 48 contiguous states or Washington, D.C., in 2019 the FPL is $16,910. So, if just the two of you file a joint tax return and your AGI + tax-exempt interest income is $67,640 (400% of $16,910) or less, you may qualify.

Understanding AGI

AGI is not only the total of those incomes that are taxed at ordinary income tax rates. If income from any source is taxed at all, it is included in your AGI. Also, AGI is your income before the standard deduction.

Your AGI includes:

- both qualified and ordinary dividends;

- the net of both short-term and long-term capital gains;

- business income or losses;

- rental income or losses; and

- deductible contributions to your Health Savings Account.

Your AGI never includes:

- The portion of your Social Security that is not taxable; or

- Qualified distributions from a retirement account, like direct rollovers to a new plan or Roth distributions.

However, don’t forget that you must ‘add back’ any tax-free interest received during the year.

When Might You Benefit from the PTC?

The people most likely to benefit from the PTC are those younger than 65 who:

- are keeping their AGI low by primarily living off Roth distributions and Social Security; or

- are self-employed and can control when their business losses occur.

To qualify for the PTC, you or a family member also must:

- Have health insurance purchased through the Health Insurance Marketplace;

- Pay the balance of the premium (after applying the advance credit payments);

- Not be eligible for affordable insurance through an employer; and

- Not be eligible for a government program like Medicaid, Medicare, and others.

These four qualifications must be met for a period of at least one month and must all be occurring during the same month. Some additional requirements include:

- Having income between 100% and 400% of the FPL for your family size;

- Not filing taxes as Married Filing Separately (with a few exceptions); and

- Not being claimed by someone else as a dependent.

If you have any questions about whether you are getting the maximum out of the Premium Tax Credit, call us at 1-844-4-Ask-Jim (1-844-427-5546) and let our Tax Planning Department review it for you.

In a previous article I discussed in detail the intricacies of

In a previous article I discussed in detail the intricacies of  With the new tax law doubling the standard deduction it is going to be much harder to itemize your tax deductions. Unfortunately, for those who give to charities this change may cause their charitable gifts to be far less valuable from a tax prospective. However, there is an excellent way to give to qualified charities as well as reduce your taxable income if you are over 70½. If you haven’t already, it’s time to start making Qualified Charitable Distributions (QCDs) from your IRA.

With the new tax law doubling the standard deduction it is going to be much harder to itemize your tax deductions. Unfortunately, for those who give to charities this change may cause their charitable gifts to be far less valuable from a tax prospective. However, there is an excellent way to give to qualified charities as well as reduce your taxable income if you are over 70½. If you haven’t already, it’s time to start making Qualified Charitable Distributions (QCDs) from your IRA. Considering the reader base of this newsletter, I assume most reading this are attempting to be good savers for retirement and are patting themselves on the back each year for peeling off portions of their earned income to save into 401(k)s and IRAs, all while reducing their current year’s tax bill. I commend you for your discipline and urge you to look even deeper into the future. As we all know the only thing guaranteed in life is death and taxes. While we can’t help you with death (perhaps my wife could as a Board Certified Palliative and Hospice Nurse Practitioner), I do think we can help reduce the tax liability you are creating for yourself in the future when you defer those taxes by saving into accounts like 401(k)s and Traditional IRAs.

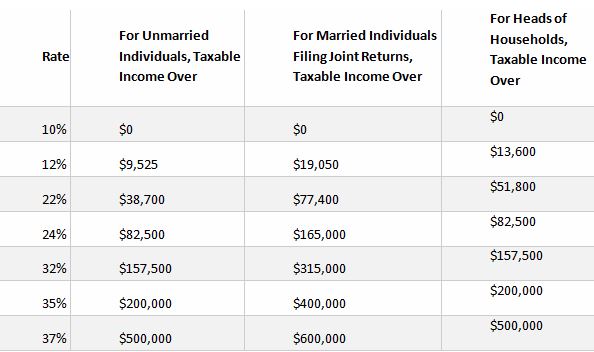

Considering the reader base of this newsletter, I assume most reading this are attempting to be good savers for retirement and are patting themselves on the back each year for peeling off portions of their earned income to save into 401(k)s and IRAs, all while reducing their current year’s tax bill. I commend you for your discipline and urge you to look even deeper into the future. As we all know the only thing guaranteed in life is death and taxes. While we can’t help you with death (perhaps my wife could as a Board Certified Palliative and Hospice Nurse Practitioner), I do think we can help reduce the tax liability you are creating for yourself in the future when you defer those taxes by saving into accounts like 401(k)s and Traditional IRAs. In the most overtly sarcastic manner, I’m sure that you are all clamoring to read the new 1097 page Tax Cuts and Jobs Act. Lucky for you I have been actively reading through the portions of it that will affect most people. Below are some bullet points you can peruse through, but if you really want to get in to the dirt the full bill can be found here.

In the most overtly sarcastic manner, I’m sure that you are all clamoring to read the new 1097 page Tax Cuts and Jobs Act. Lucky for you I have been actively reading through the portions of it that will affect most people. Below are some bullet points you can peruse through, but if you really want to get in to the dirt the full bill can be found here.

Are you receiving Social Security income, taking withdrawals from your IRA’s, or receiving a pension from a past employer? Well, as a Colorado resident you could have some tax benefits on this income. Under Colorado tax code you may be able avoid including some (or all) of this income as taxable income on your Colorado tax return. Let’s dig into some of the details.

Are you receiving Social Security income, taking withdrawals from your IRA’s, or receiving a pension from a past employer? Well, as a Colorado resident you could have some tax benefits on this income. Under Colorado tax code you may be able avoid including some (or all) of this income as taxable income on your Colorado tax return. Let’s dig into some of the details. With the real estate market showing strong growth year over year in Northern Colorado we have seen many clients purchasing rental properties to hopefully benefit from higher rents and rapid capital appreciation. This month’s article is not going to dig into the viability of such investing; rather it will overlay a perspective on how rental income, depreciation, and capital appreciation of rental properties affect one’s taxes now and later.

With the real estate market showing strong growth year over year in Northern Colorado we have seen many clients purchasing rental properties to hopefully benefit from higher rents and rapid capital appreciation. This month’s article is not going to dig into the viability of such investing; rather it will overlay a perspective on how rental income, depreciation, and capital appreciation of rental properties affect one’s taxes now and later.  Annuity income can play an important role in retirement planning because if used correctly, it can provide a steady stream of income for the rest of the annuitant’s life. However, while steady and secure income simplifies finances for annuitants (especially as they age), understanding how annuities are taxed becomes a bit more complex (not that you would ever have to figure it out on your own since the insurance companies will always report to you what is taxable, but good to know nonetheless). In this month’s article I focus on how different annuities are taxed.

Annuity income can play an important role in retirement planning because if used correctly, it can provide a steady stream of income for the rest of the annuitant’s life. However, while steady and secure income simplifies finances for annuitants (especially as they age), understanding how annuities are taxed becomes a bit more complex (not that you would ever have to figure it out on your own since the insurance companies will always report to you what is taxable, but good to know nonetheless). In this month’s article I focus on how different annuities are taxed.