By Justin Fundalinski, MBA | January 20, 2018

In the most overtly sarcastic manner, I’m sure that you are all clamoring to read the new 1097 page Tax Cuts and Jobs Act. Lucky for you I have been actively reading through the portions of it that will affect most people. Below are some bullet points you can peruse through, but if you really want to get in to the dirt the full bill can be found here.

In the most overtly sarcastic manner, I’m sure that you are all clamoring to read the new 1097 page Tax Cuts and Jobs Act. Lucky for you I have been actively reading through the portions of it that will affect most people. Below are some bullet points you can peruse through, but if you really want to get in to the dirt the full bill can be found here.

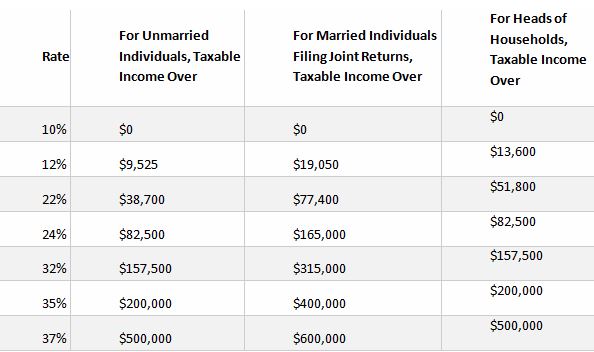

Tax Rates:

The number of marginal tax brackets was reduced from seven to…. wait a minute… seven. Although the number of brackets did not change, the numbers behind the brackets have changed through 2025. See below:

Standard Deduction:

The act drastically increased the standard deduction. This is likely where all the verbiage for “simplifying” the tax coded came from because it effectively reduces the number of people that need to itemize their deductions. (In my opinion, I never thought itemizing was all that difficult so I can’t say filing your taxes got any easier). Through 2025 the standard deduction is:

o $24,000 for married taxpayers filing joint returns

o $18,000 for heads of household

o $12,000 for all other individuals.

Personal Exemptions:

While the standard deduction went up, personal exemptions were repealed through 2025. Personal exemptions can no longer be claimed. In 2017, the personal exemption amount was $4,050, per exemption (you, your spouse, your dependents, etc…).

Passthrough Income Deduction:

Individuals will be allowed to deduct 20% of “qualified business income” from a partnership, S corporation, or sole proprietorship. Additionally, this deduction will apply to qualified real estate investment trust (REIT) dividends, qualified cooperative dividends, and qualified publicly traded partnership income. For the sake of keeping things brief in this article cannot go into details on this deduction, but if you are a small business owner you may be affected by this.

Child Tax Credit:

The act increased the child tax credit from $1,000 per child to $2,000 per qualifying child. They capped the refundable portion (the portion that you get whether or not you owe taxes) at $1,400. This credit also now begins to phase out at $400,000 for married filing joint tax payers, and $200,000 for other tax payers.

In my opinion, people that have children under the age of 17 should see this as a big win. Credits are always far better than deductions and the fact the credit doubled in addition to more people being eligible for it with the increased phase outs is going to make a big difference come tax time.

Alimony:

For any divorce or separation agreement executed or amended after December 31, 2018, alimony and separate maintenance payments are no longer deductible by the paying spouse. That is, if you’re paying alimony you (instead of your ex-spouse) will have to pay the taxes on it, and if you’re receiving alimony it will be tax free income to you.

The act essentially reverses the way alimony payments are treated for tax purposes. But if you think about it, there will be more taxes payed on the same amount of income earned. Generally, the one paying alimony is the higher earning spouse, and if that is income is now taxable at their higher marginal rates then more tax will be collected.

IRA Recharacterizations:

You can no longer undo a Roth conversion. A lot more upfront planning will need to be done when before you do a Roth conversion. You will no longer be able to figure out the appropriate amount to convert come tax time in April, rather you will need to figure it out before December 31st (a time when you might not have all the info you need to decide how much would be appropriate to convert).

Sale of a Principal Residence:

Although there was much talk about changing the rules behind the exclusion of capital gains on the sale of a principal residence, nothing was changed here. Phew!

Itemized Deductions:

Although most people won’t need to itemize their deductions anymore because of the increased standard deduction, there were various changes to itemized deductions. Here are a few of the bigger items:

The overall limitation on itemized deductions was removed through 2025.

Mortgage interest deduction was modified to reduce the limit on acquisition indebtedness from $1,000,000 to $750,000.

You can no longer deduct home equity loan interest.

State and local tax deductions are limited to $5,000 ($10,000 for married filing joint)

Miscellaneous itemized deductions subject to the 2% floor have been repealed.

The threshold for deduction medical expenses was reduced to 7.5% of adjusted gross income for 2017 and 2018.