By Justin Fundalinski, MBA | November 15, 2015

The new budget law with bipartisan approval by Congress has effectively dismantled Social Security claiming strategies that retirees and financial planners have come to rely on to generate steady and secure income throughout retirement. Unfortunately, these changes will unequivocally impact those who have planned their retirement around certain expectations that Social Security claiming options would be available. This article is meant to inform how the budget bill has reformed “restricted applications” and “file and suspend” claiming strategies as well as describe who may be impacted by this.

Restricted Applications:

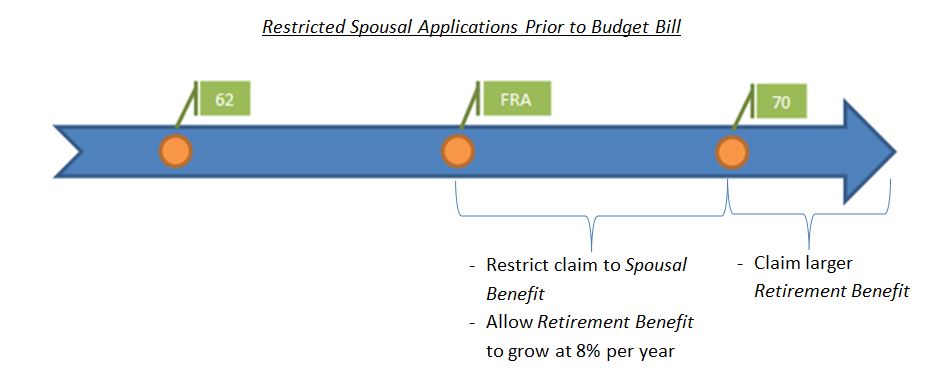

Prior to the new law taking affect, Social Security claimants who are Full Retirement Age (ages 66-67) or later could choose to “restrict” their claim to only Spousal Benefits. This restriction would allow them to claim their Spousal Benefit and delay claiming their Retirement Benefit until age 70. The late claiming of Retirement Benefits allowed the claimant to accrue “Delayed Retirement Credits” and enhance their Retirement Benefit by 8% per year. Since a claimant could claim a smaller Spousal Benefit for several years and enhance their Retirement Benefit, this strategy was often coined the “Claim Now, Claim More Later” strategy. See the timeline below for a simplified understanding of this strategy.

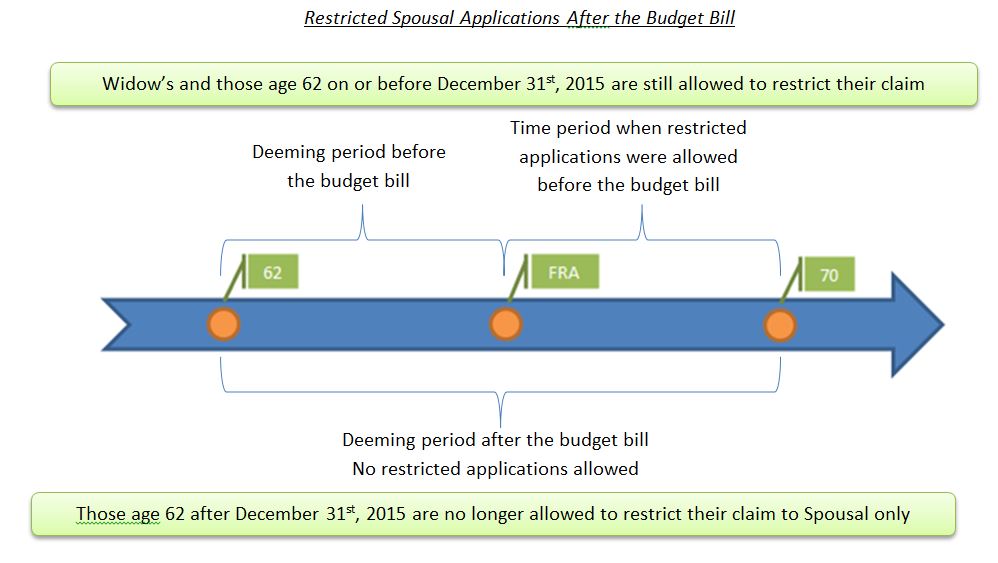

This simple strategy that allowed substantial growth of a Retirement Benefit is now off the table for anyone who is not 62 by December 31st, 2015[1]. The new law essentially extends what Social Security calls “deeming.” Prior to the law, any claimant who filed for their benefit before Full Retirement Age was deemed (or forced) to claim the highest benefit available to them. Basically, Social Security would turn on all of the benefits that the claimant is entitled to, cut a check to the claimant for the highest benefit available at the time, and disallow the opportunity to delay Retirement Benefits for further growth. The new law now extends this concept beyond Full Retirement Age and applies it at all times for Spousal and Retirement Benefits. This effectively eliminates the opportunity to “Claim Now, Claim More Later.”

It is imperative to note that that these changes do not include Widow’s Benefits, and that widows and widowers can continue to restrict their claim to Widow’s Benefits and delay claiming their Retirement Benefits. On the other hand Divorced Spousal Benefits are impacted by the bill, and the same new rules will apply regarding restricted applications. That is, if one is not age 62 on or before December 31st, 2015 they will not be able to restrict their claim to only Divorced Spousal Benefits and allow their own Retirement Benefit to grow.

See the timeline below for a better understanding of these changes.

File and Suspend:

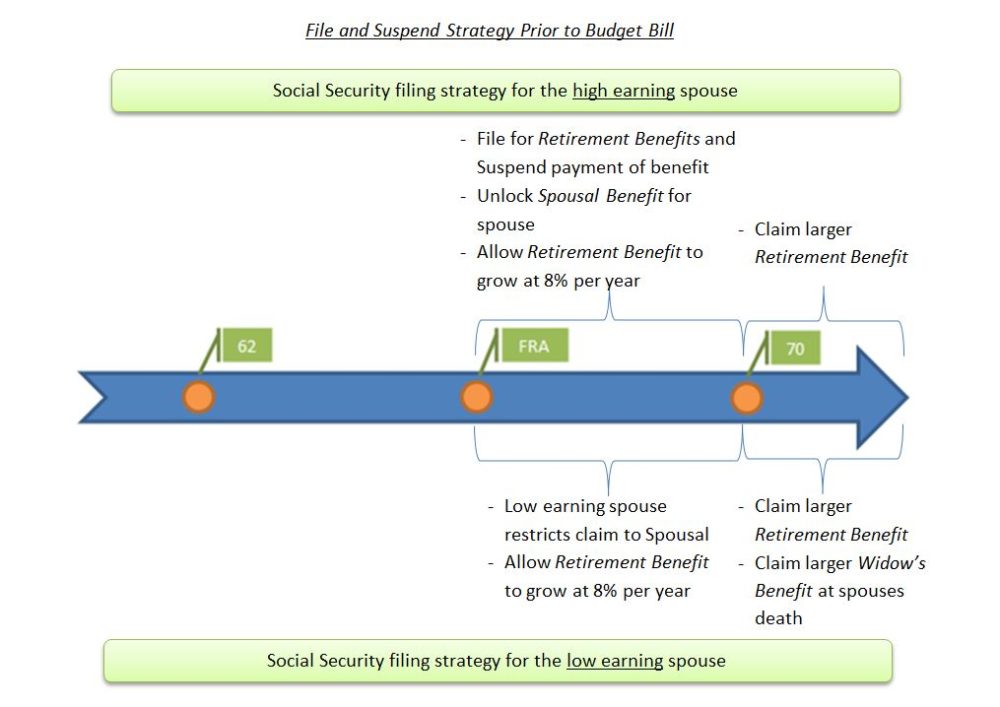

Under current Social Security rules, once a claimant reaches Full Retirement Age they are able to file for their benefits, and at any time prior to age 70 they can suspend the payment of their benefit. The reason someone would want to do this is because they have effectively filed for Social Security benefits which “unlocks” the opportunity for specific members of the family to claim a benefit using the earnings record of this person (for example, someone can only claim their Spousal Benefits if their spouse has already filed for Social Security benefits . At the same time, the suspension of benefits allows the claimant to earn the Delayed Retirement Credits of 8% per year. Essentially, this strategy opens the door for someone to file a restricted application for Spousal Benefits without affecting the Retirement Benefits of the other spouse and allows for the accrual of Delayed Retirement Credits.

This strategy is especially helpful for couples in which one spouse had higher earnings throughout their lifetime than the other. This is because it allows the higher earner to delay their claim, earn the Delayed Retirement Credits, collect a higher benefit while they are alive, and pass on the higher benefit as a Widow’s benefit when they decease. See the timeline below for more details.

The new law has changed how benefits are “unlocked” for those who can claim on somebody else’s earning record. Suspending benefits is still possible, however it is no longer the act of filing for benefits that unlocks this opportunity; rather, it is the act of receiving the benefit that does. In other words, suspending a Retirement Benefit also suspends benefits for those that can claim based on someone else’s earnings record. In order for a higher earner to open up the door for their spouse to claim Spousal Benefits they would have to claim and receive the benefit, forfeit the Delayed Retirement Credits, collect a lower benefit throughout retirement, and pass on this lower benefit as a Widow’s benefit when they decease. The claiming strategies and benefits around filing and suspending Social Security benefits have been erased.

May Also Apply to Divorced Individuals

Notably, this change may also apply to divorced individuals who are claiming on their ex-spouses earnings record. While we don’t expect this to be true, it is not clear in the bill how they will treat divorced spouse benefits in a file and suspend scenario. The final answer to this is pending and will likely be determined based on how Social Security interprets the new law.

Fortunately, the bill was amended from its original draft to allow those who have already filed and suspended or those that file and suspend within 180 days of this bill’s enactment to be grandfathered into the old set of rules. While it is a fast timeframe for this rule to take place, it at least does not ruin the filing strategies that people already implemented.

Other Noteworthy Items:

- Prior to the new budget law, any claimant that filed and suspended their benefit could choose to receive a lump sum payout of the benefits that they suspended and resume their benefit schedule as if they filed at Full Retirement Age. For example, this strategy may have been utilized by a single recipient who decided to file and suspend their benefits with the intent to earn Delayed Retirement Credits, but also give them the opportunity to back out and receive a lump sum of the “missed payments” if the money was need or wanted (as may be in the case of a diagnosis of a terminal illness). Lump sum payments from suspended benefits are longer an option.

- More often than not, restricted benefits are used in conjunction with a file and suspend strategy. So, while the changes that are being made to restricted benefits have a longer time frame for enactment compared to that of the changes made to filing and suspending benefits, many of the reasons for taking a restricted claim will be off the table anyways.

- Finally, there are still many reasons to include Social Security planning with income planning and with the recent changes it is even more important now than ever. Total household income drawn from Social Security is likely to be lower because the benefits of waiting are not as great as they used to be. Notably, Social Security income for survivors may be greatly impacted because file the file and suspend strategies that significantly increased a survivor’s income will be less appealing. Other income or assets need to be in place to fill this gap and active income planning may help retirees overcome the changes in Social Security claiming rules.

As always, if you have any questions please feel free to contact us at the office.

References:

http://newlaw.socialsecuritytiming.com/

https://maximizemysocialsecurity.com/node/688

[1] By definition, those with a birthdate of January 1st,1954 (or those who turn 62 on January 1st,2016) are age 62 as of December 31st, 2015 in the eyes of Social Security.